Top Forex Brokers-Forex Weekly news and analysis For August 19 – 25, 2024

| 📢Heads-Up: New Product Release 🚀 15 NEW Instruments Just Launched! Trade Gold Mining Stocks & Thematic Indices Now! We are delighted to introduce 15 new instruments on our Classic Pro and Classic Standard accounts! This includes 10 Gold Mining Stocks and 5 Thematic Indices, providing you with a wealth of new trading opportunities. 🏭Explore the Gold Sector with 10 Leading Gold Mining Stocks: 💰 #FCX – Freeport-McMoRan Inc 💰 #NEM – Newmont Corporation 💰 #AEM – Agnico Eagle Limited 💰 #FNV – Franco-Nevada Corporation …and more! 📊 Trade Our Latest Instrument Category: Thematic Indices 💹$$EV_INDX: Ride the electric vehicle wave 💹$$AI_INDX: Invest in the AI revolution 💹$$CRYPTO: Explore small-cap crypto opportunities 💹$$METALS: Diversify with industrial metals 💹$$FAANG: Top 10 Nasdaq tech leaders Ready to diversify and conquer new markets? Let’s trade! 💪 |

| Trade Now |

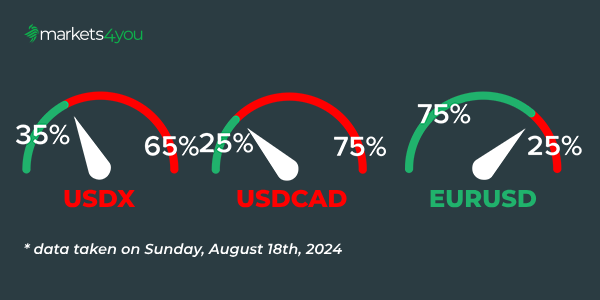

| The Market’s Mood |

|

| Weekly Wrap-Up US factory gate prices increased by 0.1% month-over-month in July 2024, following a 0.2% rise in June. The annual inflation rate in the UK edged up to 2.2% in July 2024, from 2% in June. The annual inflation rate in the US slowed to 2.9% in July 2024, the lowest since March 2021, compared to 3% in June. The British economy stalled in June 2024 from May, following a 0.4% growth in the previous period. US retail sales soared by 1% month-over-month in July 2024, following a downwardly revised 0.2% drop in June and surpassing forecasts of a 0.3% gain. UK retail sales increased by 0.5% month-over-month in July 2024, recovering from a revised 0.9% drop in June. |

| This Week’s Highlights This week’s key economic releases are scheduled as follows: Canada Consumer Price Index (CPI) (Wednesday) US FOMC Meeting Minutes (Wednesday) UK, US, EU Flash Manufacturing PMI (Thursday) UK, US, EU Flash Services PMI (Thursday) US Unemployment Claims (Thursday) Canada Retail Sales (Friday) |

| Watch Weekly Insights |

| Pair of the Week EUR/USD |

|

| This week, expect high volatility in the EUR/USD pair due to economic events in the Eurozone and the FOMC meeting minutes from the US. Resistance: 1.1128; 1.1225 Support: 1.0941; 1.0848 |

| Trade Now |

| USD/CAD |

|

| This week, expect high volatility in the USD/CAD pair due to economic events in Canada and the FOMC meeting minutes from the US. Resistance: 1.3785; 1.3902 Support: 1.3590; 1.3473 |

| Trade Now |