Top Forex Brokers – Forex Weekly news and analysis For August 25 – 31, 2025

PCE and GDP will be crucial for the Fed

This week, traders expect two essential releases that will impact the US dollar:

•GDP and unemployment claims

•core PCE price index

Together, they will help us understand how healthy the US economy is and what we should expect from inflation. This will determine overall expectations regarding the Fed’s policy and the USD direction.

Thursday, August 28

GDP QoQ 2nd est + Initial Jobless Claims

At the symposium in Jackson Hole, Powell signaled a dovish policy stance. Since the economy is slowing down, easing is possible depending on the situation in the labor market. If the US economy continues to overheat, it would weaken the US dollar.

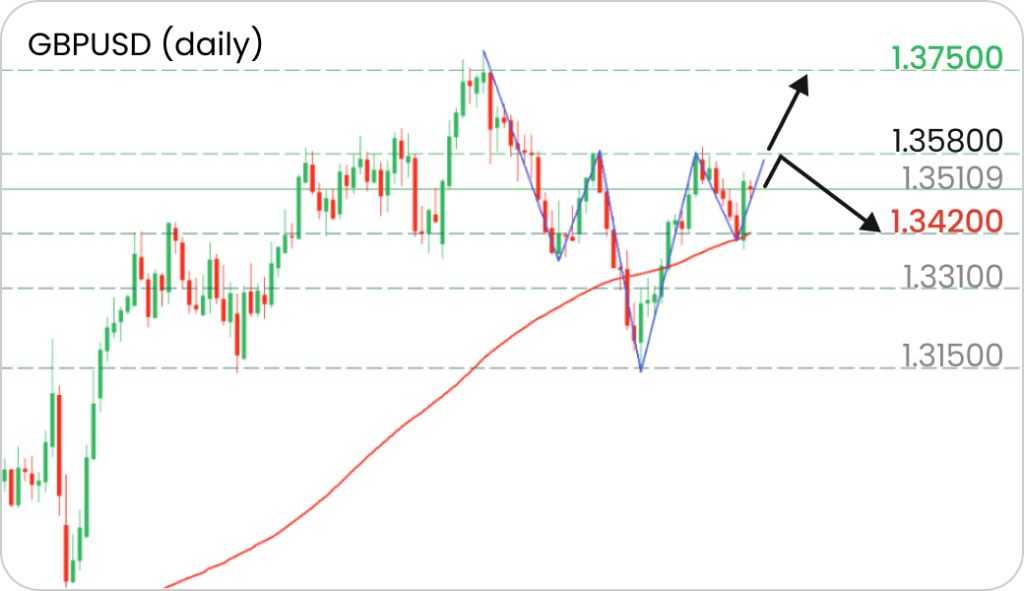

GBPUSD rebounded from the 100-MA and grew, forming the head and shoulders pattern. The price aims to retest the 1.3580 resistance level with two possible scenarios:

If the price breaks above the 1.3580 resistance, the upside will be toward 1.3750.

However, GBPUSD will return to the 1.3420 support if the retest fails.

Friday, August 29

Core PCE Price Index MoM

The index measures changes in the price of goods and services and excludes volatile food and energy. The Fed relies on this index to determine its monetary policy. A higher-than-expected value may push the USD and bond yields higher, while a lower reading can cause monetary policy easing.

Gold navigates sideways, forming a symmetrical triangle pattern. The price is sandwiched between the 3380 resistance and the 3330 support, so we can we can consider the following possibilities:

If the price breaks above 3380, the next target will be the 3430 resistance.

However, breaching below the 3330 will cause gold to fall to the 3270 support.

•Most Trusted Broker — 2025

These awards confirm our commitment to building a rewarding trading environment and helping you uncover your potential. Thank you for choosing to trade with an award-winning broker!

Choose MetaTrader 5 with Top Forex Brokers?

•Blazing-fast execution & enhanced stability

•38 built-in technical indicators & 21 timeframes for precision trading

•Optimized for all devices—desktop, mobile & web

•Trade a wide range of assets: Stocks, Commodities, Forex & more!

https://www.topforexbrokerscomparison.com

*Tips and analytics do not constitute a call to trade, trading advice or recommendation and are for information only.