Top Forex Brokers – Forex Weekly news and analysis For September 15 – 21, 2025

The US and UK central banks may cause chaos

This week, all eyes are on the Federal Reserve and the Bank of England. Markets expect the Fed to ease, while the BoE is likely to remain neutral. Mixed data could drive volatility in USD and GBP.

Wednesday, September 17

The Fed Federal Funds Rate

The Fed is expected to cut rates from 4.25%–4.50% in September. Inflation remains sticky at 2.9%, while the latest NFP added only 22K jobs, well below expectations. With price pressures holding and hiring slowing, many investors now see easing as the likely next move.

XAUUSD navigates within a symmetrical triangle, sandwiched between 3650 resistance and 3630 support.

A break above 3650 could push prices toward 3675.

A drop below 3630 may trigger a move down to 3600.

Thursday, September 18

The BOE Official Bank Rate

The focus is on the BoE, with the Official Bank Rate at 4.00%. A hold is likely as the bank weighs inflation against growth risks. Markets will watch the vote split: a clear hold could steady GBP, while hawkish hints may spark volatility.

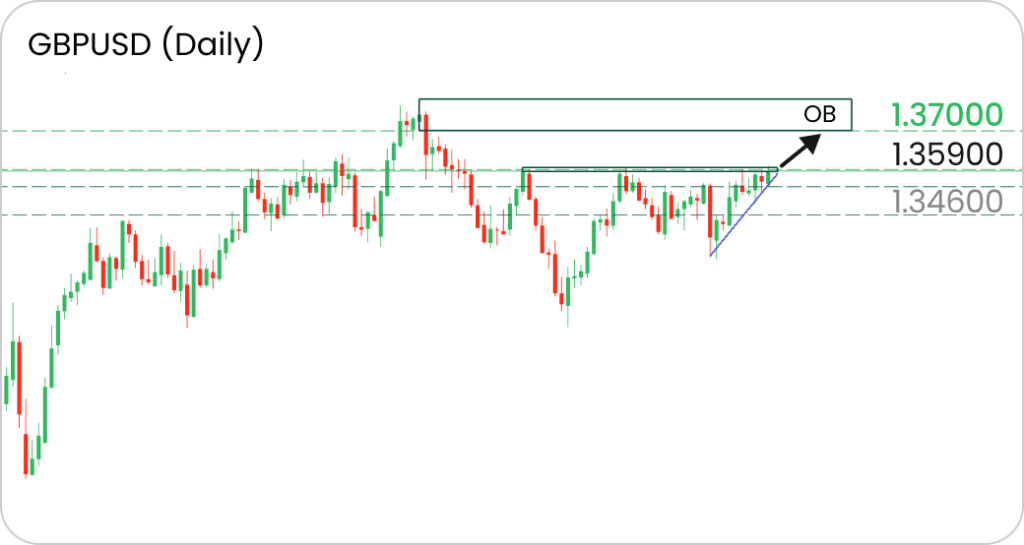

The price navigates within a local trendline, facing the 1.3590 resistance area.

If the price breaks above 1.3590, it may increase toward 1.3700 resistance.

•Most Trusted Broker — 2025

These awards confirm our commitment to building a rewarding trading environment and helping you uncover your potential. Thank you for choosing to trade with an award-winning broker!

Choose MetaTrader 5 with Top Forex Brokers?

•Blazing-fast execution & enhanced stability

•38 built-in technical indicators & 21 timeframes for precision trading

•Optimized for all devices—desktop, mobile & web

•Trade a wide range of assets: Stocks, Commodities, Forex & more!

https://www.topforexbrokerscomparison.com

*Tips and analytics do not constitute a call to trade, trading advice or recommendation and are for information only.